In this series of blogs I’m going to look at the various concerns that financial advisers may have in relation to structured products. This blog focuses on the first issue – lack of liquidity. I’m going to try to demystify and clear up some of the concerns that advisers have.

Liquidity is an important consideration for advisers contemplating asset classes and when making recommendations on any type of product or fund. So how liquid are structured products?

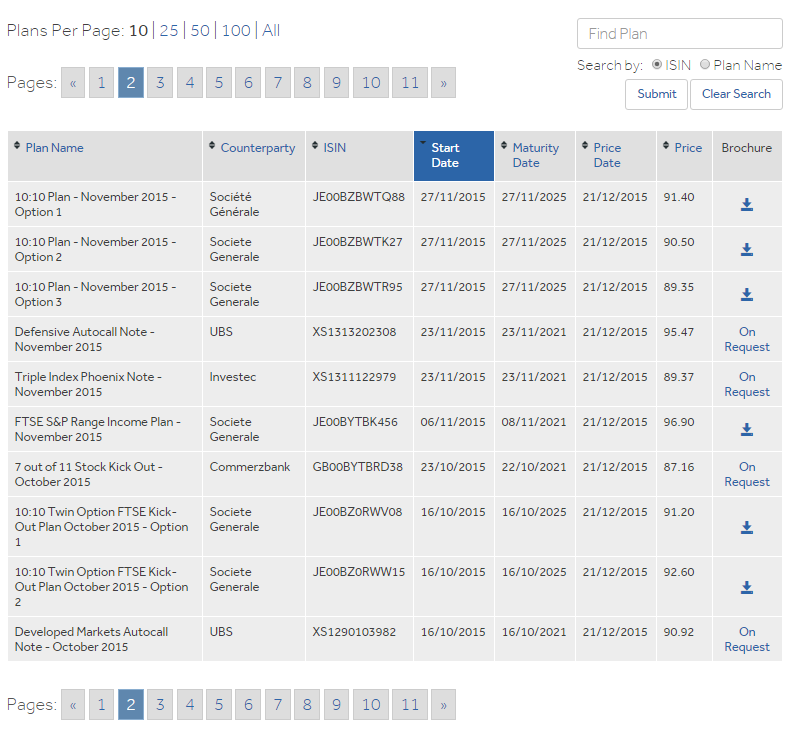

Therefore, it is possible for an adviser or client to see an up-to-date valuation on a structured product and make a decision as to whether to execute a surrender on that price almost immediately. Units can be sold on the same day that the request is made and following this, money can be returned to the client or the originating platform.

Below is a screen grab from the Valuations section of our website as of 22 December 2015. As can be seen, all listed products have a current valuation based on the last trading price, which is the closing price the previous day. This information is continuously available for advisers to access and take action if appropriate.

Mariana has expertise in valuing all forms of structured products, both from the buy and sell side and want to achieve the best price for clients in order to maximize repeat business. And because banks want repeat business from Mariana they are sharp with their secondary prices so that when tested, expectations are not compromised.

When Mariana believes there is value in a secondary price we speak to the relevant Financial Adviser to bring this to their attention. Communication is only ever done with the Financial Adviser and not with the client and so it is then up to the adviser to decide whether they think it is a viable opportunity for their client.

An example of this might be a product which has a maximum cap on the return and the secondary market price is at a point where the difference between the cap and the secondary market price (on a compounded annualised basis) means that the client might have better opportunities to reinvest the proceeds of their investment elsewhere.

On an advised basis and at the point of recommendation, structured products should be seen as buy-to-hold, but when we do think there are products where value is represented in the secondary market price we will inform our IFA clients of this.

Liquidity, rightly so, will continue to be a crucial consideration when looking at suitable client investments and structured products should not be discounted from consideration for this reason.

Not found your answer? Live chat is the quickest way to get in touch with a real person at Mariana or call us on 020 7065 6699

Start live chat »